One of Exness’s most notable strengths is its emphasis on security and regulatory compliance. Licensed by reputable regulatory bodies, including CySEC and the FCA, Exness protects client funds with measures like segregated accounts and negative balance protection. Additionally, Exness provides 24/7 multilingual support, reinforcing its status as a reliable choice for traders around the world.

Why Exness Broker Receives Positive Reviews

- Regulation and Security: Regulated by top-tier authorities, Exness offers a secure and trustworthy trading environment.

- Clear Fee Structure: With competitive spreads and no hidden fees, Exness ensures transparency in its cost structure.

- Fast Withdrawals: Known for almost instant withdrawals, Exness makes accessing funds quick and hassle-free.

- Diverse Account Types: Exness caters to different trader levels, offering a variety of account options for beginners to professionals.

- Low Initial Deposit: With a low minimum deposit requirement, Exness makes trading accessible to newcomers.

- Advanced Trading Platforms: Exness provides popular platforms like MetaTrader 4 and MetaTrader 5, as well as its proprietary platform.

- Educational Resources: From tutorials and webinars to market analysis, Exness equips traders with resources to enhance their skills.

- High Leverage Options: Flexible leverage options allow traders to increase market exposure.

- 24/7 Multilingual Support: Exness’s around-the-clock multilingual support ensures traders can always access assistance.

- Wide Asset Range: Offering forex, commodities, cryptocurrencies, and indices, Exness provides a broad spectrum of trading opportunities.

- No Requotes: The no-requote policy enables fast and smooth order execution, a key feature for active traders.

- Negative Balance Protection: Exness ensures clients do not lose more than their initial investment.

- Automated Trading Support: The broker supports automated trading through expert advisors (EAs).

- Trusted Reputation: With years in the industry, Exness has built a solid and trustworthy reputation among global traders.

- Stable Trading Environment: Minimal slippage and reliable servers create a steady trading experience.

Comprehensive Security Features of Exness Broker

Exness is deeply committed to ensuring the security of client accounts and funds in today’s digital landscape, where cyber threats are increasingly sophisticated. To provide a secure trading environment, Exness has implemented robust security measures that safeguard user data and financial transactions, making it a trusted broker worldwide.

1. Two-Factor Authentication (2FA)

Exness employs two-factor authentication (2FA) to protect account access. This method requires users to enter their password along with a unique verification code sent to their mobile device. By combining two verification steps, 2FA greatly reduces the risk of unauthorized access, even if a user’s password is compromised. 2FA is particularly beneficial because:

- Enhanced Security: Requiring two forms of verification adds a substantial layer of security, making it difficult for unauthorized parties to breach accounts.

- Protection Against Phishing: Even if phishing attempts successfully capture a user’s password, they cannot access the account without the unique code from the user’s mobile device.

- User Control: Exness users can enable or disable 2FA in their account settings, allowing them to customize their security preferences.

2. SSL Encryption

To protect data integrity and privacy, Exness uses Secure Socket Layer (SSL) encryption for all data exchanged between users and the platform. SSL encryption is a critical security measure that ensures sensitive information, such as personal details and financial transactions, remains unreadable to any third party attempting to intercept it. Key benefits of SSL encryption include:

- Data Confidentiality: SSL encryption makes information indecipherable, providing peace of mind for traders sharing sensitive details.

- Preventing Man-in-the-Middle Attacks: This type of encryption prevents malicious actors from intercepting and manipulating communications between the trader’s device and Exness’s servers.

- Compliance with Security Standards: SSL encryption helps Exness maintain compliance with security protocols, demonstrating its commitment to industry standards for client protection.

3. Segregated Client Accounts

Exness goes a step further in protecting client funds by using segregated accounts. This practice involves keeping client funds separate from the broker’s operational funds, ensuring that client money is protected and remains unaffected even in case of Exness’s financial challenges. The advantages of segregated accounts include:

- Enhanced Transparency: By separating funds, Exness ensures that clients’ money is used solely for trading activities and not for the broker’s own business operations.

- Safeguarding Client Money: In the unlikely event of financial difficulties, segregated accounts protect client assets, as they cannot be claimed by creditors.

- Confidence in Fund Security: Exness’s transparent approach in handling client funds fosters greater confidence and peace of mind among traders.

4. Real-Time Activity Monitoring

Exness actively monitors user accounts for any suspicious activity to prevent unauthorized access and mitigate risks. This monitoring includes tracking factors such as IP addresses, login locations, and trading patterns. If unusual activity is detected, Exness can respond promptly and notify clients to take necessary actions, enhancing overall account security. Real-time activity monitoring benefits traders in several ways:

- Immediate Alerts: Clients receive real-time alerts for unusual login attempts or trading behavior, allowing them to take swift action if an unauthorized attempt occurs.

- Behavior Analysis: By analyzing login locations, IP addresses, and trading patterns, Exness identifies potential threats proactively.

- Increased Client Protection: This feature adds an extra layer of protection, ensuring that users are informed and can act quickly to secure their accounts if needed.

5. Regular Security Audits and Compliance

Exness regularly conducts security audits to ensure that its systems meet the highest standards of data protection. These audits help Exness identify and address any vulnerabilities, ensuring a continuously secure trading environment for clients. Furthermore, Exness’s compliance with regulatory authorities, including the FCA and CySEC, adds another layer of security by enforcing strict standards in fund protection and data handling. Key benefits of regular audits and compliance include:

- Identification of Security Gaps: Regular audits enable Exness to detect and address security gaps, maintaining robust protection for client data.

- Regulatory Assurance: Compliance with international regulatory bodies ensures Exness follows rigorous guidelines, providing a secure and trustworthy trading experience.

- Client Trust: Exness’s transparent approach to regulatory compliance enhances client trust and reinforces its reputation as a reliable broker.

6. Negative Balance Protection

Exness provides negative balance protection to ensure that clients cannot lose more than their initial investment, even in highly volatile markets. This feature automatically closes positions to prevent further losses once the account balance approaches zero. Negative balance protection is particularly valuable for:

- Risk Management: This feature helps clients manage their exposure to risk, especially during volatile market conditions.

- Protection Against Rapid Market Movements: Sudden, extreme changes in the market can lead to significant losses, but negative balance protection shields traders from owing additional funds.

- Ensuring Financial Stability: By preventing traders from incurring debts, Exness promotes financial stability for clients, making it a suitable choice for all experience levels.

7. Account and Transaction Verification

To protect users further, Exness requires identity verification and transaction confirmation. New accounts must complete identity verification by submitting documentation, such as proof of identity and address, to access full account functionality. Verification also applies to transactions, adding an extra layer of security to deposits and withdrawals. Benefits of this verification include:

- Enhanced Identity Security: Identity verification minimizes risks associated with account impersonation and unauthorized access.

- Transaction Safety: Requiring confirmation for withdrawals and other transactions helps prevent unauthorized transfers.

- Compliance with Anti-Money Laundering (AML) Policies: Verifying user identities aligns Exness with AML regulations, contributing to a secure and transparent trading environment.

8. Multi-Layered Infrastructure and Server Security

Exness has implemented multi-layered security protocols across its servers to safeguard user data and trading activities. This infrastructure includes firewall protections, intrusion detection systems, and high-level encryption for server communications. The benefits of such infrastructure include:

- Server Integrity: Firewalls and other protections ensure that only authorized users and verified data exchanges occur within Exness’s network.

- Reliable Access: With secure servers, clients experience minimal downtime and uninterrupted trading, even during peak market hours.

- Continuous System Monitoring: Exness employs round-the-clock monitoring of its servers, identifying and responding to potential security risks promptly.

9. Customer Education on Security Best Practices

Exness provides clients with guidance on security best practices, empowering them to take active roles in protecting their accounts. By educating users on the importance of strong passwords, the dangers of phishing attempts, and secure trading habits, Exness supports a secure trading environment. Advantages of customer education include:

- Increased Security Awareness: Educating clients on potential risks helps them make safer choices when using the platform.

- Reduced Risk of Phishing and Fraud: By recognizing fraudulent activity, users are better equipped to avoid scams and suspicious links.

- Promotion of Secure Login Practices: Exness encourages the use of strong passwords and 2FA, reducing the likelihood of unauthorized access.

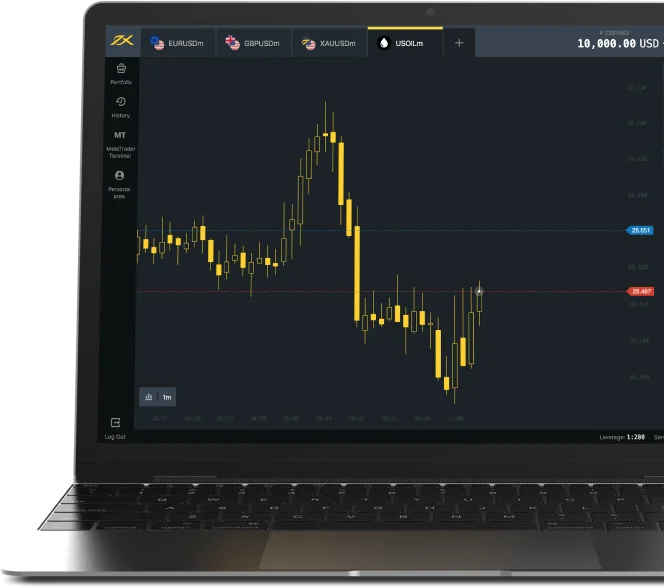

Trading Platforms Offered by Exness

Exness is a prominent global broker that provides access to various financial markets through powerful trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized as industry standards, offering advanced tools and features that cater to a range of trading styles. Here’s a closer look at MT4 and MT5 to help you decide which is best suited for your trading needs.

MetaTrader 4 (MT4)

MetaTrader 4, introduced in 2005, is renowned for its ease of use, making it particularly popular among Forex traders.

Key Features of MT4:

- User-Friendly Interface: MT4’s simple and intuitive design makes it accessible for beginners and experienced traders alike.

- Advanced Charting Tools: With multiple timeframes, technical indicators, and graphical tools, traders can conduct detailed market analysis.

- Automated Trading with Expert Advisors (EAs): EAs allow traders to automate trades based on preset algorithms, enhancing trading efficiency.

- Broad Range of Assets: MT4 supports Forex, commodities, and indices trading.

- Mobile Compatibility: Available on both iOS and Android, MT4 enables trading on the go.

- Low System Requirements: MT4 operates smoothly on less powerful devices and slower internet connections.

Who Should Choose MT4? MT4 is ideal for traders focused mainly on Forex who don’t require advanced tools like market depth or a wide array of asset classes. It’s a perfect choice for traders who are comfortable with automated trading and prefer a straightforward, reliable platform.

MetaTrader 5 (MT5)

MetaTrader 5, launched in 2010, builds on MT4’s success by adding advanced features, making it a robust choice for traders with diverse needs.

Key Features of MT5:

- Market Depth: MT5 offers market depth, displaying bid and ask prices at various liquidity levels.

- Expanded Timeframes and Indicators: MT5 has 21 timeframes and 38 technical indicators, compared to MT4’s 9 timeframes and 30 indicators.

- Multi-Asset Trading: Besides Forex, MT5 supports CFDs on stocks, commodities, cryptocurrencies, and futures, offering more trading diversity.

- Integrated Economic Calendar: The economic calendar on MT5 provides real-time market event updates that may influence trades.

- Faster Order Execution: MT5’s architecture enhances order execution speed, a valuable feature in fast-moving markets.

- Hedging and Netting Options: MT5 supports both hedging (like MT4) and netting, giving traders flexibility in managing positions.

- Advanced Strategy Testing: MT5 enables multi-currency and multi-threaded strategy testing, allowing for refined strategy optimization.

Who Should Choose MT5? MT5 is ideal for advanced traders needing extra analysis tools, rapid execution, or access to more asset classes beyond Forex. It’s suitable for traders who want market depth data or who plan to use the netting system in addition to hedging.

Deciding Between MT4 and MT5

Choosing the right trading platform is essential for optimizing your trading experience with Exness. Both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer unique features and advantages tailored to different trading needs.

- Choose MT4: This platform is ideal for beginners, Forex-focused traders, and those who want a straightforward, resource-efficient trading experience. MT4 is also well-suited for traders who rely on automated trading, as it has a proven, stable system with robust support for Expert Advisors (EAs).

- Choose MT5: MT5 is designed for experienced traders who want access to a broader range of asset classes beyond Forex, such as stocks and commodities. It offers advanced charting tools, market depth features, and faster order execution, making it more versatile for multi-asset and complex trading strategies.

Both MT4 and MT5 are excellent platforms, each tailored to specific trading styles. If your focus is mainly on Forex with a simple interface, MT4 is a dependable choice. If you’re seeking advanced features, faster execution, and diverse asset options, MT5 is the better fit.

How to Start Trading with Exness Broker

Starting your trading journey with Exness is straightforward and secure. Here’s a step-by-step guide to help you open and manage your account on Exness:

1. Visit the Official Exness Website

Begin by visiting the official Exness website. Type “Exness” into your web browser, and make sure you’re on the correct site to avoid phishing scams.

2. Register an Account

Click on the “Open Account” or “Register” button on the homepage. Provide your email, select your country of residence, and set a secure password.

3. Verify Your Email

After registration, Exness will send a verification email. Click the link in the email to confirm your address and activate your account.

4. Complete Personal Information

Log into your new account and fill in your personal details, such as your name, address, and phone number. This step is required to meet regulatory standards and secure your account.

5. Submit Verification Documents

Upload a copy of a government-issued ID (passport, national ID, or driver’s license) and a recent document showing proof of address (such as a utility bill or bank statement). Verification is necessary for full access to your account and is important for security.

6. Select an Account Type

Exness offers various account types—Standard, Raw Spread, Zero, and Pro. Each has different features to suit different trading styles, from spread and leverage options to commission structure. Choose the one that best fits your needs.

7. Download a Trading Platform

Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Trader app. Download and install your preferred platform directly from the Exness website.

8. Log into the Trading Platform

Use the login credentials (login, password, and server) provided by Exness to access your trading platform. You’ll receive these details via email.

9. Deposit Funds

Go to the Personal Area on the Exness website, select “Deposit,” and choose your preferred payment method (bank transfer, credit/debit card, or e-wallets like Skrill or Neteller). Ensure that the deposit meets the minimum requirement for your chosen account type.

10. Select a Trading Instrument

Exness offers a wide selection of assets, including Forex, metals, cryptocurrencies, indices, and commodities. Pick an instrument based on your knowledge and trading strategy.

11. Practice with a Demo Account (Optional)

If you’re new to trading, try using a demo account first. Exness offers a demo account with virtual funds, allowing you to practice and get comfortable with the platform before using real money.

12. Develop a Trading Strategy

Before placing trades, establish a trading strategy that includes risk management, entry/exit points, stop-loss levels, and lot sizes. Understand how leverage works and use it according to your risk tolerance.

13. Place Your First Trade

On your trading platform, select the asset you want to trade. Decide if you want to go long (buy) or short (sell), set your lot size, and confirm your trade. Be sure to use stop-loss and take-profit orders to manage risk.

14. Monitor Market Trends

Stay informed about market news, trends, and economic events that may impact your trades. Use your platform’s charting tools and technical indicators to analyze market movements.

15. Withdraw Your Profits

If your trades are successful, go to the withdrawal section in the Personal Area. Exness supports withdrawals via the same methods as deposits, and transactions are typically processed quickly.

16. Continue Learning

The markets are constantly evolving, so it’s essential to keep learning. Exness provides educational resources, including webinars, tutorials, and market analysis, to help traders improve their skills.

17. Practice Risk Management

Stick to your trading plan, avoid emotional decisions, and use tools like stop-loss orders, trailing stops, and position sizing to manage risk.

18. Reach Out for Support

If you encounter any issues with your account or trades, Exness offers 24/7 customer support through live chat, email, and phone. Their support team can help resolve issues promptly.

FAQ

What is Exness, and how does it work?

Exness is an online broker offering access to various financial markets like Forex, commodities, and cryptocurrencies. It provides tools for all levels of traders, focusing on transparency and low trading costs.