- Simplified Profit and Risk Calculations: The calculator allows users to input their investment amount, leverage, and target profit levels to see potential returns and associated risks. This simplifies the process of estimating outcomes for different trades, enabling traders to strategize effectively.

- Improved Strategic Planning: By presenting potential profit scenarios and risk exposure, the calculator aids in strategic financial planning. Traders can use this data to establish clear financial goals, adjust risk tolerance, and make better-informed investment choices.

- Enhanced Understanding of Market Scenarios: The calculator shows how various investment and leverage combinations can impact overall returns, helping traders visualize different trading scenarios. This helps them understand market behavior and adjust their trading approach accordingly.

- User-Friendly Interface: With its intuitive design, the calculator is easy to navigate, allowing users to assess investment opportunities without requiring an in-depth background in finance.

Functions and Tasks of the Exness Investment Calculator

The Exness Investment Calculator provides several core functions to support traders in decision-making and market analysis:

- Market Analysis: The calculator integrates historical price trends, economic indicators, and sentiment data to offer a comprehensive market overview. This feature ensures that traders have insight into the current market state, helping them identify favorable investment opportunities across different instruments like forex, commodities, and stocks.

- Trend Predictions: By analyzing past and current market data, the calculator identifies potential upward or downward trends. Using advanced algorithms, it can highlight market patterns, enabling traders to enter positions early or adjust existing trades in response to projected market changes.

- Fund Allocation Recommendations: The calculator provides suggestions on fund distribution based on a user’s risk tolerance, desired returns, and available budget. This feature helps users diversify their portfolios in line with their financial goals, promoting a balanced approach to investment.

Comparing the Exness Investment Calculator to Analogues

While many investment calculators are available, the Exness Investment Calculator stands out due to its precision, advanced technology, and user-oriented design. Here’s how it compares to other tools:

- Accuracy and Real-Time Data Integration: Unlike many calculators that rely on outdated or static data, the Exness calculator incorporates real-time data, ensuring that calculations reflect the latest market conditions. This level of accuracy allows users to make decisions based on current trends and information.

- Advanced Algorithms for Precise Forecasting: The Exness calculator’s algorithms are designed to provide reliable trend predictions, improving traders’ ability to anticipate market movements. Many alternative tools lack this level of sophistication, which can lead to less accurate forecasts.

- Reliability and Transparency: Exness is known for its transparency and commitment to quality, which is reflected in the reliability of its investment calculator. Users can trust that the results they receive are dependable, a standard that many other calculators struggle to match.

- User-Friendly and Accessible Design: With its clear interface, Exness’s calculator makes investment analysis accessible for users with all levels of financial expertise. While other calculators may have similar features, few combine simplicity with advanced functionality as seamlessly as Exness does.

The Exness Investment Calculator is an invaluable resource for traders aiming to maximize their returns while managing risk effectively. Whether you are a beginner or an experienced trader, this calculator supports clear, data-driven decision-making, offering a reliable foundation for optimizing trading strategies and enhancing overall investment success.

How to Set Up and Run the Exness Investment Calculator

To get started with the Exness Investment Calculator, follow these steps for an efficient setup:

- Log into Your Exness Account:

- Begin by opening the Exness website and logging into your account using your credentials.

- Once logged in, navigate to your main dashboard, which displays various account details and trading tools.

- Navigate to the Tools Section:

- On the left-hand side menu, look for the “Tools” section. This section houses various analytical tools, calculators, and trading features.

- Click on “Investment Calculator” (or a similarly named option) to access the calculator interface.

- Select the Asset:

- Once the calculator is open, start by choosing the asset you wish to trade, such as forex, commodities, or indices.

- Selecting the correct asset is crucial, as each instrument has unique characteristics and market conditions that will impact your calculations.

- Enter Investment Amount:

- Input the amount of capital you plan to invest. This figure represents the initial sum you are committing, which will serve as the base for calculating potential returns and risks.

- Set Leverage:

- Enter the leverage you intend to use for the trade. Leverage directly affects both potential gains and risks, so adjust it carefully based on your risk tolerance and trading strategy.

- Exness allows you to set your leverage through either a slider or a direct input field, depending on the calculator’s interface.

- Specify Take-Profit and Stop-Loss Levels:

- Set target levels for both take-profit and stop-loss. These parameters help define your potential profit and limit possible losses, ensuring you have a structured approach to risk management.

- Adjust these levels in line with your overall trading strategy to strike a balance between potential earnings and risk exposure.

- Run the Calculator:

- Once all parameters are set, click on the “Calculate” or “Run” button to generate results.

- The calculator will display estimated profits, losses, and other relevant metrics, giving you a clearer view of the possible outcomes based on your chosen settings.

- Review and Adjust as Needed:

- Analyze the results provided by the calculator to assess if your investment and risk parameters align with your trading goals.

- Adjust any fields if needed to test alternative scenarios, allowing you to explore different potential outcomes.

The Exness Investment Calculator is a powerful tool that simplifies complex calculations and provides clarity on expected returns and risks. By accurately setting your inputs, you can leverage the calculator to make data-driven decisions and improve your trading strategy.

Recommendations for Choosing a Trading Platform on Exness

To select the optimal trading platform within Exness, consider the following factors:

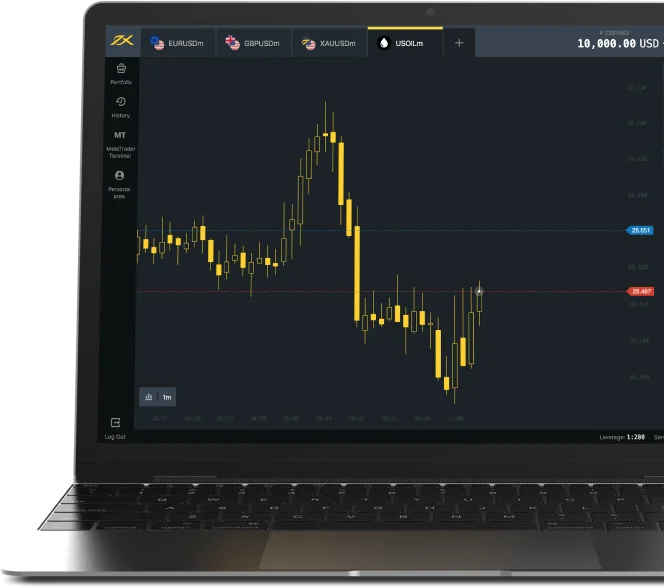

- User Interface and Experience:

- Choose a platform with an intuitive, user-friendly layout that simplifies navigation and accessibility.

- Check if it offers a smooth trading experience, allowing quick access to charts, analytical tools, and essential trading features.

- Range of Trading Instruments:

- Verify the variety of instruments available for trading. Exness offers a broad selection, including forex, commodities, indices, stocks, and cryptocurrencies.

- Ensure the platform provides the specific financial assets you plan to trade to meet your portfolio needs.

- Regulation and Security:

- Confirm Exness’s regulatory status under reputable bodies, such as the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), to protect your funds.

- Look for security features like two-factor authentication (2FA) and encryption to safeguard your account and personal data.

- Availability of Trading Tools and Features:

- Evaluate the availability of advanced charting tools, technical indicators, and data analytics that facilitate effective market analysis.

- Consider whether the platform supports automated trading options like copy trading, algorithmic trading, and other advanced strategies that align with your trading preferences.

- Mobile Accessibility:

- For those who trade on the go, check if Exness offers a reliable mobile app that retains the same functionality as the desktop version.

- Test the app for smooth performance, stability, and ease of use to ensure it supports your trading needs regardless of your location.

- Customer Support:

- Review the accessibility and quality of Exness’s customer support. Look for 24/7 support options through channels such as live chat, email, or phone.

- Ensure support is available in your preferred language for clear and effective communication.

- Fees and Spreads:

- Compare Exness’s fee structure with your trading strategy to find the most cost-effective options.

- Platforms with competitive spreads and lower commissions can better align with strategies focused on frequent or high-volume trades.

- Demo Account Availability:

- A demo account is essential for new users to practice trading without financial risk. Exness provides a demo account that mirrors live trading conditions.

- Use the demo account to familiarize yourself with the platform’s features, tools, and order execution processes before committing real funds.

Who Can Use the Exness Investment Calculator?

The Exness Investment Calculator is a versatile tool, beneficial to a broad range of users, each with unique investment goals and needs. Here’s a breakdown of the various individuals and professionals who can leverage this calculator to enhance their financial decision-making:

- New Investors

- Ideal for those just starting out, the calculator helps beginners estimate potential returns on small investments, offering clarity and confidence as they make initial market decisions.

- Experienced Traders

- Seasoned investors can use the tool to refine their strategies, testing different scenarios and predicting outcomes for complex portfolios across multiple assets.

- Financial Advisors

- Advisors managing client portfolios can model various investment plans, providing tailored advice based on predicted returns and risks for each strategy.

- Students Studying Finance

- Finance students can apply theoretical knowledge to real-world scenarios, using the calculator to simulate market behaviors and deepen their understanding of investment principles.

- Entrepreneurs

- Business owners exploring diverse income streams can evaluate the potential profitability of new investments, aiding in strategic planning and diversification.

- Retirement Planners

- Individuals planning for retirement can project long-term returns, helping ensure that their investment strategies align with their financial stability goals.

- Risk-Averse Investors

- Cautious investors can use the calculator to gauge potential risks and returns before committing funds, making it easier to approach investments strategically and confidently.

- Day Traders

- Short-term traders benefit by calculating daily profits and losses, enabling more informed tactical decisions and helping maximize potential returns from high-frequency trades.

- Forex Traders

- The calculator’s currency-specific functions make it particularly useful for Forex traders who wish to estimate earnings based on market trends and leverage conditions.

- Wealth Managers

- Professionals managing high-net-worth portfolios can optimize strategies by modeling returns and risks, ensuring the best outcomes for clients seeking wealth growth and protection.

As Benjamin Franklin aptly said, “An investment in knowledge pays the best interest,” which is what the Exness Investment Calculator offers—a pathway to smarter, well-informed investment decisions.

How to Make a Deposit with Exness Broker

To make a deposit on the Exness platform, start by ensuring you have an active trading account. After logging in to your Exness client area, go to the “Deposit” section. Here, you’ll find a variety of deposit options, including bank cards, e-wallets, and local payment systems. Select the method that works best for you and follow the instructions to proceed with your deposit.

After choosing your preferred payment method, enter the deposit amount, keeping in mind the minimum requirements specific to each method. Some methods may also require additional information or verification steps to meet regulatory standards. Double-check your account details to avoid delays in the processing of your deposit.

Confirm the transaction once all details are entered. The processing time for deposits varies: e-wallets often process instantly, while bank transfers might take up to several business days. You may receive a confirmation from Exness regarding your successful deposit, so keep an eye on notifications or emails.

Finally, verify that the funds have been credited to your account by checking your balance in the Exness client area. If the funds do not appear within the expected timeframe, contact Exness support for assistance. Following these steps carefully ensures a smooth deposit process, allowing you to focus on trading.

Recommended Reading for Traders

For a solid understanding of trading, start with books that provide foundational knowledge and strategies. “A Random Walk Down Wall Street” by Burton Malkiel explores market behaviors and investment approaches, emphasizing the importance of trends and market psychology. Another valuable read, “Market Wizards” by Jack D. Schwager, compiles interviews with top traders, offering real-world insights and strategies.

In addition to books, online resources are essential for keeping up with market developments. Investopedia and TradingView are popular platforms offering tutorials, analysis tools, and up-to-date market news. These resources help traders understand technical indicators, analyze charts, and make informed decisions. Online forums and communities also provide opportunities for knowledge exchange, where traders can share experiences and strategies.

Can You Trust an Investment Calculator?

- Developed by Experts: Investment calculators are created by skilled programmers working with experienced financial professionals, using well-established financial models and tested strategies. This collaboration ensures that the calculators produce accurate projections based on reliable algorithms and sound financial theories.

- AI-Powered Precision: Modern investment calculators often use AI to handle large data sets and provide personalized predictions. AI continuously adapts to new information, enhancing the calculator’s ability to offer precise estimates by accounting for subtle changes in market conditions.

- Regular Updates for Accuracy: To reflect the dynamic nature of markets, reputable calculators are regularly updated. These updates ensure that calculations align with current economic indicators, regulations, and market strategies, adding to the reliability of results.

- Real-Time Data Integration: Connected to the internet, many calculators access real-time financial data, allowing them to provide estimates based on the latest stock prices, interest rates, and other market factors. This real-time capability makes them a trustworthy tool for making timely, informed investment decisions.

FAQ

How do I use the Exness Investment Calculator?

Simply enter your trade parameters, such as currency pair, trade size, and leverage. The calculator will generate an estimate of potential gains or losses based on these inputs.