Exness operates under major financial regulators such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), ensuring high standards in security and client protection. Additionally, traders benefit from features like negative balance protection and segregated accounts, which add an extra layer of fund security and enable a confident, focused trading experience.

How to Create an Account with Exness Trading Broker

Setting up an account with Exness is straightforward. Here’s a step-by-step guide to ensure a smooth and secure registration:

Step 1: Visit the Exness Website

- Go to the official Exness website, ensuring you are on the correct site by checking for “https://” and a padlock symbol in the address bar to avoid phishing risks.

Step 2: Start the Registration Process

- Click on “Open Account”: Find this button on the homepage to begin registration.

- Select Your Country of Residence: Choose your actual country of residence, as this may affect available features and required documents.

- Enter Your Email and Create a Password: Use an active email address and a strong password with a mix of letters, numbers, and symbols.

- Choose Account Type: Exness offers standard and professional account types. Choose the type that best aligns with your trading style and needs, as it can impact leverage, spreads, and trading conditions.

Step 3: Verify Your Account

- Identity Verification: Upload a clear, valid government-issued ID (passport, national ID, or driver’s license).

- Address Verification: Submit a recent document, such as a utility bill or bank statement, showing your full name and address. Ensure it is not older than 3-6 months.

- Email and Phone Verification: Complete verification by entering the codes sent to your email and phone number.

Step 4: Set Up Security and Preferences

- Enable Two-Factor Authentication (2FA): For added account security, activate 2FA using an app like Google Authenticator.

- Configure Preferences: Choose your account’s base currency and set up leverage based on your risk tolerance. Adjust settings in your account dashboard to suit your trading style.

Step 5: Fund Your Account

- Navigate to the Deposit Section: Click on “Deposit” in the main dashboard.

- Select Payment Method: Exness offers bank transfers, credit cards, e-wallets, and cryptocurrency options.

- Enter Deposit Amount: Ensure your deposit meets the minimum requirements for your account type.

- Complete Payment: Follow the prompts to complete the transaction. Processing times vary based on the payment method, with e-wallets typically being instant.

Step 6: Download and Configure the Trading Platform

Exness supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both industry-standard trading platforms.

- Download the Platform: Go to the “Platforms” section on the Exness website and select either MT4 or MT5.

- Install and Log In: Open the platform after installation, logging in with your account number, server, and password.

- Customize Your Trading Environment: Set up charts, indicators, and templates for efficient trading.

Step 7: Start Trading

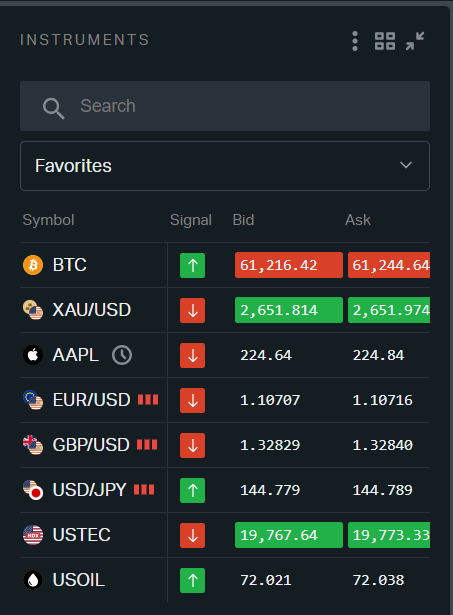

With your account funded and platform configured, you’re ready to start trading. Exness provides access to a wide variety of assets, from forex to stocks, commodities, and cryptocurrencies. Take time to explore Exness’s trading resources, educational content, and customer support to enhance your skills and understanding of the market.

Requirements for a Trader to Register on the Exness Trading Platform

Exness has a structured registration process to ensure that all traders meet necessary standards and regulatory requirements, creating a safe trading environment. Below are the key requirements for a trader looking to register on the Exness platform:

1. Minimum Age Requirement

- Age Requirement: Traders must be at least 18 years old to register on Exness. This requirement ensures traders have the legal capacity to enter into binding agreements and understand the risks associated with trading.

2. Personal Information and Verification

- Accurate Personal Details: During registration, traders must provide accurate information, including full name, date of birth, and residential address. This information must align with the verification documents submitted.

- Verification Documents: Traders need to complete a Know Your Customer (KYC) verification by submitting proof of identity (e.g., passport or government-issued ID) and proof of residence (e.g., utility bills or bank statements). This verification is essential for Anti-Money Laundering (AML) compliance and allows Exness to confirm the trader’s identity, ensuring a safe trading environment.

- Verified Status: Only fully verified accounts have unrestricted trading capabilities on the platform.

3. Email Address and Phone Number

- Valid Contact Information: A current email address and phone number are required for account activation. Exness uses these for sending confirmation codes for security purposes, as well as for ongoing communication, updates, and account-related notifications.

4. Account Type Selection

- Choosing an Account Type: Exness provides various account options—Standard, Raw Spread, Zero, and Pro. Traders need to select the account type that aligns best with their trading goals and experience, as each account type offers unique features, spreads, and commission structures that can impact trading costs and conditions.

5. Financial Information

- Financial Profile Details: Exness may request traders to provide financial information, such as employment status, annual income, trading experience, and source of funds. This helps the platform understand a trader’s experience and objectives, ensuring that appropriate trading products and resources are recommended.

Security of Registration and Data Provision in Exness Broker

Exness has established a reputation for implementing some of the most advanced security protocols in the trading industry. This strong commitment to security ensures that clients’ personal and financial information remains protected from the moment of registration to ongoing account transactions and management.

Registration Security

From the very beginning, Exness prioritizes the security of user registration. When a new client registers on the platform, Exness applies high-level encryption methods to protect any information exchanged between the user’s device and Exness servers. This is accomplished using Secure Sockets Layer (SSL) technology, which encrypts all transmitted data, making it nearly impossible for third parties to intercept or decipher sensitive information.

To further enhance security, Exness employs additional protection measures during registration:

- CAPTCHA Systems: These are used to detect and prevent bot registrations, ensuring that only real users gain access.

- Two-Factor Authentication (2FA): Exness requires users to set up 2FA during registration, adding a second layer of verification to prevent unauthorized access.

Data Provision and Storage Security

Once a trader is registered, the protection of their personal data becomes a priority. Exness complies with global data protection standards, including the General Data Protection Regulation (GDPR) and local privacy laws where applicable. This compliance underscores Exness’s dedication to high data privacy and security standards.

Key security measures include:

- Advanced Encryption Standard (AES) 256-bit Encryption: Exness encrypts all sensitive data, including identity documents, financial details, and transaction records, with 256-bit AES encryption—the strongest form of encryption currently available.

- Secure Databases with Access Restrictions: Exness stores data in highly secure databases that only authorized personnel can access, and even then, under strict conditions. This segmentation ensures that personal and financial data is compartmentalized and isolated from general access, reducing the risk of internal and external threats.

Transaction and Withdrawal Security

The security of financial transactions, including deposits and withdrawals, is another area where Exness applies multi-layered safeguards. Each transaction is subjected to stringent verification procedures to prevent unauthorized actions and ensure the integrity of client funds.

Security Measures for Transactions and Withdrawals:

- Multi-Layer Authentication: Every transaction requires verification from both the client and Exness, reducing the risk of fraud.

- Identity Verification: For high-level transactions, Exness may request biometric confirmation or 2FA, further enhancing security.

- Withdrawal Verification Steps: To prevent unauthorized access, Exness requires multiple steps for withdrawal approvals, including:

- Password entry for each transaction

- Security codes sent to registered email addresses or phone numbers

- Biometric verification (for users with compatible devices)

These steps ensure that even if a user’s login credentials are compromised, additional security measures prevent unauthorized withdrawals.

Preventing Unauthorized Access

To safeguard user accounts and data, Exness employs advanced monitoring tools and artificial intelligence algorithms that continuously analyze account activity for signs of suspicious behavior. If anomalies like repeated failed login attempts or logins from unfamiliar IP addresses are detected, the account is immediately secured, and the client is alerted. This proactive strategy effectively prevents breaches by identifying and neutralizing risks early on.

Clients are strongly encouraged to enable Two-Factor Authentication (2FA) for enhanced security. This feature requires a one-time code from an external app like Google Authenticator in addition to the regular login credentials. As a result, even if login information is compromised, unauthorized access remains blocked, providing an essential layer of security.

Compliance and Data Privacy Policies

Exness goes beyond technical defenses by enforcing stringent internal policies and meeting global regulatory standards. The broker undergoes regular security audits, penetration tests, and infrastructure assessments to identify and remedy potential weaknesses. These evaluations are performed by independent third-party firms, ensuring objectivity and thoroughness in securing Exness’s systems.

Additionally, Exness maintains a transparent Privacy Policy that explains how client data is collected, stored, and protected. Data is only shared with third parties under client consent or where legally required, ensuring clients remain informed about how their information is managed. This transparency helps build trust and gives clients control over their personal data.

Secure Communication Channels

All interactions between clients and Exness are conducted through secure, encrypted channels to protect data transmission. For web-based communication, Transport Layer Security (TLS) protocols are used, ensuring that all information exchanged, such as support queries or document submissions, remains confidential. Exness’s mobile apps also utilize secure APIs to safeguard communication, guaranteeing that sensitive client data is protected across all devices and platforms.

Features and Importance of Account Verification in Exness Broker

Account verification is a fundamental process with Exness, serving as a safeguard for secure and legitimate trading. By completing this process, traders ensure that their personal information and financial transactions are protected, creating a secure trading environment.

Key Features of Account Verification at Exness

- Identity and Address Confirmation: Exness requires traders to provide valid identity and address documents, such as a passport, national ID card, or utility bill. This step confirms the identity and residence of each trader, essential in maintaining transparency.

- Fraud Prevention: Verifying accounts helps Exness prevent fraudulent activities, including identity theft and money laundering. It aligns with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, ensuring that all trading activities comply with international standards.

- Transaction Limits and Benefits for Verified Accounts: Verified accounts enjoy higher transaction limits and access to more favorable trading conditions. This not only rewards verified users but also provides enhanced benefits for those engaged in high-volume trading, such as increased leverage options and higher withdrawal limits.

- Enhanced Customer Support: Verified traders have prioritized access to customer support, particularly beneficial when resolving disputes or account issues. Exness’s approach ensures that verified clients can resolve concerns quickly and with full support.

Importance of Account Verification with Exness

- Compliance with Regulatory Standards: Exness’s verification requirements help maintain compliance with regulatory standards across regions. This compliance safeguards client funds and builds trust, as clients can be assured that Exness adheres to established financial protocols.

- Access to Exclusive Features: Verified traders gain access to exclusive trading features, such as special promotions and higher withdrawal limits, that enhance their trading experience. For those trading at higher volumes, verified status unlocks benefits essential for maximizing trading potential.

- Risk Reduction for All Parties: Verifying accounts reduces the risk associated with unverified users. Exness can focus its resources on supporting genuine clients, reducing potential disruptions from fraudulent or unauthorized activities.

- Efficient and User-Friendly Process: Exness streamlines the verification process to minimize delays. Traders can upload documents directly on the platform, with document reviews typically completed within hours. Exness also provides guidance on acceptable documents, making it easy for clients to meet requirements without complications.

Account verification with Exness is more than a formality—it builds a secure foundation for trading by preventing fraud, enhancing compliance, and supporting verified traders with access to exclusive benefits. Through this simple yet thorough process, Exness ensures that both new and seasoned traders can focus on their trading journey within a safe, transparent, and supportive environment.

FAQ

How do I register for an Exness account?

To get started with Exness, go to the official website and click on the “Open Account” button. Enter your personal information and follow the prompts to complete the registration.